What is ponzi.fan?

Born from the ashes of the memecoins craze of 2024-2025. Seeking a fairer, more transparent system that gives everyone a better chance to win, we created what is now known as ponzi.fan.

PvE, not PvP

Ponzi.fan is designed around socio-economic dynamics that grant its users passive yield and shield them from liquidity extraction. Each pyramid/ponzi aligns all participants toward growing the system, rather than creating a high-stress environment where users race to dump first, leaving others with worthless bags. Over time, pyramids' curve designs will evolve to become even fairer, encouraging more users to join and ensuring long-term sustainability.

Rugpull-proof

Liquidity cannot be pulled out of ponzis, tokens cannot be pumped and dumped to oblivion, and similar exploitative scenarios are impossible. The curve design ensures a fair and transparent system, encouraging healthy participant behavior. Additionally, the Ponzi.fan protocol is fully trustless — all mechanics are executed on-chain via smart contracts, with no off-chain calculations.

Comparing ROI: Ponzi.fan vs. Pump.fun

The best ROI comparison for Ponzi.fan is with the dominant trend since 2024: memecoins. To establish this comparison, we can look at pump.fun, the largest meme-launching platform. While we don't have direct access to the ROI of pump.fun users, we do have data on the percentage of users who made a profit:

- 0.003% of users made $10K+

- 0.0004% made $100K+

- 0.00002% made $1M+

As we can see, the percentage of profitable users drops by an order of magnitude for every 10x increase in profits. source: https://dune.com/adam_tehc/pump-fun-alpha-wallets

In the case of Ponzi.fan, each curve and community will have a unique distribution profile. Based on simulations, the percentage of users in profit could range from 20% to 65%. Using a simulation of 10,000 random curves—where 10,000 participants join each one, contributing an amount randomly chosen between $10 and $1,000—we obtain the following results:

- Top 20% tranche [0-20%) → Median ROI: 10x to 1,000x

- Next 20% tranche [20-40%) → Median ROI: 2.5x to 50x

- Next 20% tranche [40-60%) → Median ROI: 1.5x to 7.5x

How does it work

The math behind Ponzi.fan works in two steps:

- Pool Split Calculation In the first step, each participant receives a value that represents their percentage ownership of the total pool inflow. For example, if you contribute 100 $USDC to a pool with a total of 1,000 $USDC, your ownership is 10%. As more participants join and add another 1,000 $USDC, the total inflow grows to 2,000 $USDC, and your ownership is now 5%.

- Curve effect calculation

This is where the magic happens and where each pyramid can be designed with its own specific vision. Each participant in a pool is assigned a position. The first participant gets position 1, the second gets position 2, and so on. To apply the curve and determine each participant’s final share of the pool, we use a bit of calculus:

- We calculate the area under the curve from one participant’s starting position to their next position. For a curve where x = 0, 1, the first position starts at a = 0 and ends at b = 0 + ownership percentage. For someone with 10% pool ownership, their interval would be 0, 0.1. The next position starts at a = 0.1 and ends at b = 0.15 for someone with 5% pool ownership.

- To determine a participant’s final share of the distribution, we calculate the fraction of their interval area relative to the total area under the curve. For example, if someone’s interval area is 50 and the total area under the curve is 200, their share would be 0.25 or 25% of the next pool distribution.

All of these calculations must be repeated for each new participant who joins the pool. To minimize computation costs, these calculations are done approximately every 3 hours, with all participants who joined during that period grouped together in one batch. Anyone can call the distribution function.

How to create a ponzi pool

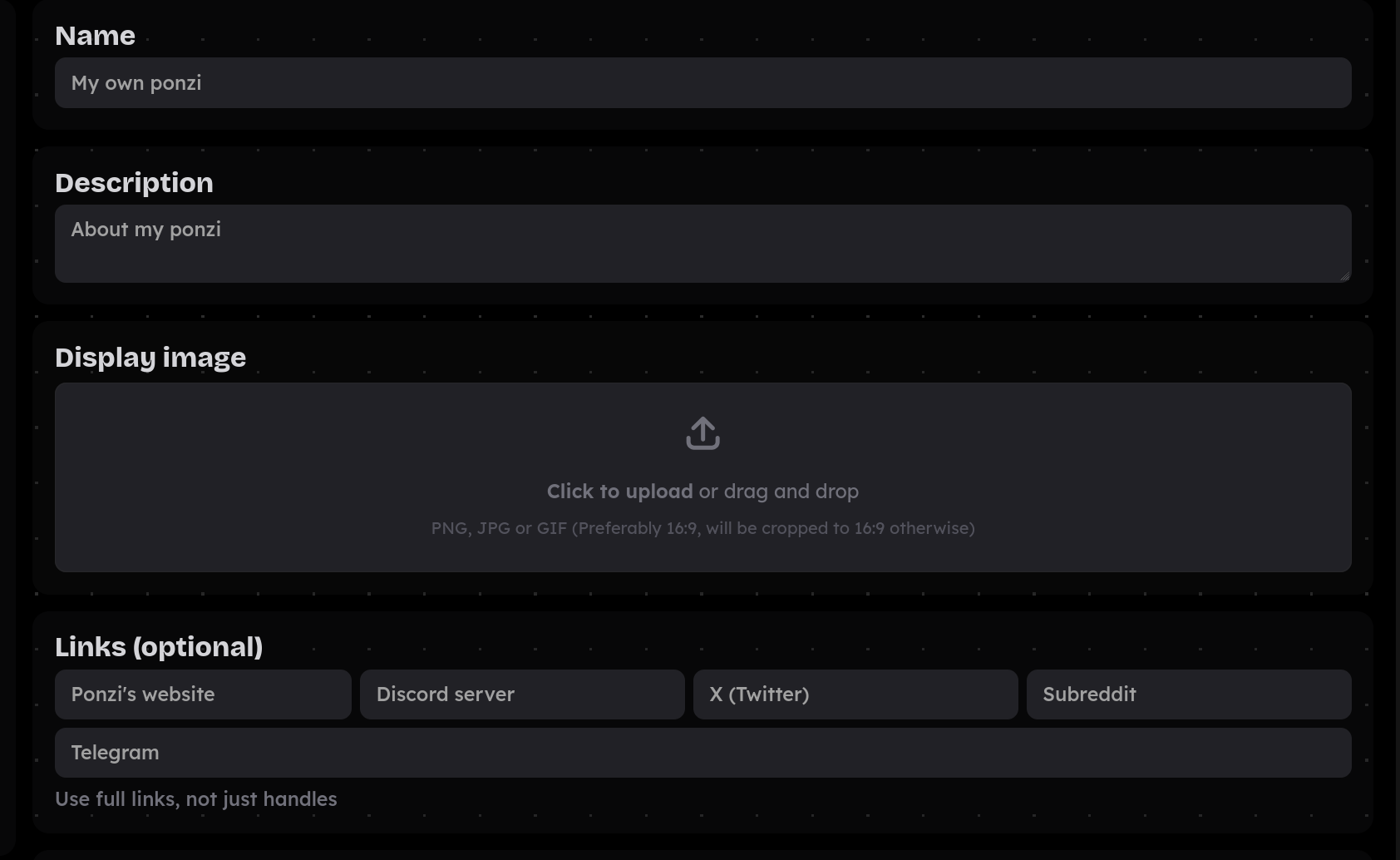

- The metadata

Name your ponzi, provide a description, and upload an image that best represents it. This is optional, but you can also include links to your ponzi's Twitter, Telegram, Discord, Subreddit, and website if available.

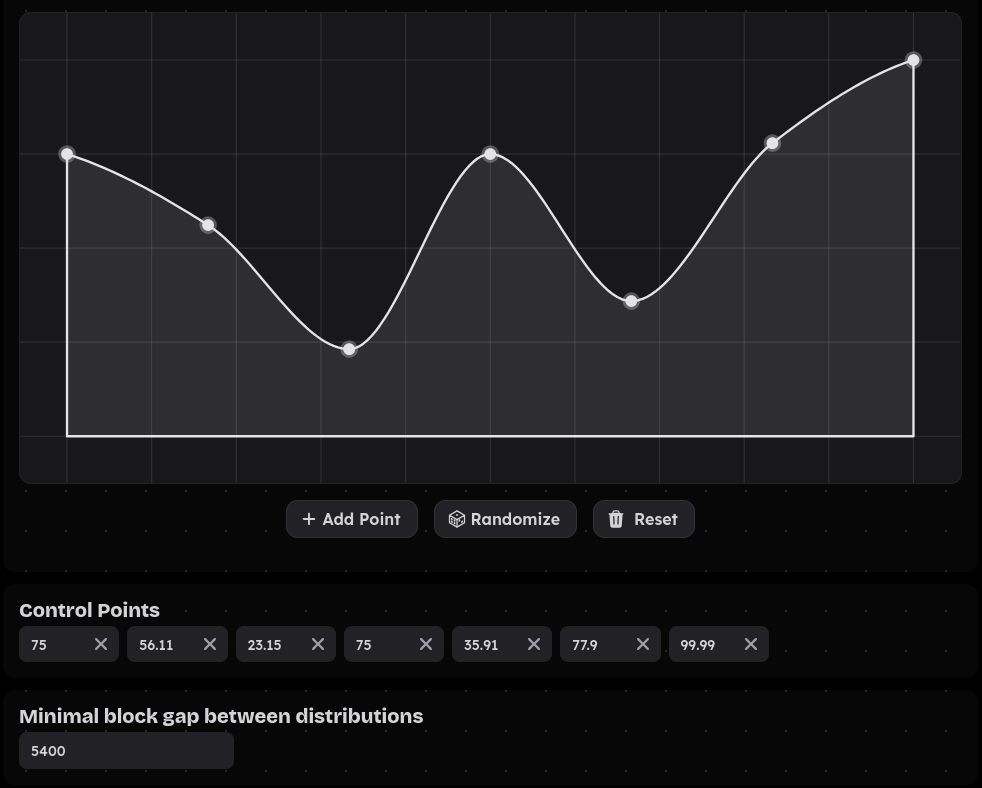

- The curve design

This step allows each pool to have its own unique vision. For example, you could design a pool that rewards early adopters, or one that maximizes rewards for late entrants. Alternatively, you could create a design with a high degree of randomness. See How does it work to understand the math behind the curves. In the graph below, you can adjust any point by moving it up or down. To add points, click on Add Point. The minimum number of points is 2, and the maximum is 60. Note that if you choose only two points, it will automatically create a flat curve. The minimum value of a point is 1.01 and the maximum is 99.99. You can also use the Randomize button to generate a random curve.

We recommend adding as many points as you think you'll need when designing your curve. It's easier to remove the last few points than to add new ones and readjust the entire curve. You can also fine-tune the y value of each point using the respective parameter below the graph. You can also adjust the block gap to set the minimum time between each distribution. An estimated time per block gap is shown to the right of the input.

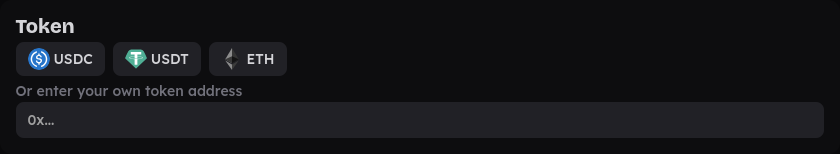

We recommend adding as many points as you think you'll need when designing your curve. It's easier to remove the last few points than to add new ones and readjust the entire curve. You can also fine-tune the y value of each point using the respective parameter below the graph. You can also adjust the block gap to set the minimum time between each distribution. An estimated time per block gap is shown to the right of the input. - Choose your token

Finally, you can choose any ERC20 token to be the asset accepted by your ponzi. This will be the only currency accepted by your ponzi.

NFT positions

To give users the ability to trade, go long, or short on their positions, each position is represented as a tradable NFT following the ERC-721 standard. Additionally, it enables lending and borrowing of any position. By commoditizing positions as NFTs, ponzi.fan opens the door for protocols to be built on top of it, greatly expanding its potential and functionality.

Transfer credits

To transfer your position NFT, you’ll need to purchase transfer credits. A minimum of 2 transfer credits are required, as this is the number needed to list an NFT on a marketplace. There’s technically no maximum to how many transfer credits you can purchase. Each transfer costs 0.5% of your position's size. This fee is redistributed as inflow to all holders within the same pool as the NFT for which the transfer was purchased.

About fees

The platform doesn't take any fees before you made profits. I repeat, we don't take ANY fees before you are in profit. You win, we win.

The fees model is as follows:

e= user's total percentage returnsf_b= base fee (1.25%)f_m= max fee (9%)

If e < 1: fee_rate=0

If you earned less than your initial deposit, no fees are applied to your earnings.

If e > 4: fee_rate = f_m

If you earned more than 4x your deposit, the fee is capped.

If 1 ≤ e ≤ 4: fee_rate = f_b + ( (e - 1)/3 * (f_m - f_b) )

For returns between 1x and 4x, a linear formula is used to calculate the fee, starting from the base fee and gradually increasing to the max fee.

Contract addresses

Factory contract address: 0x529a2131451e830B5E916b52514BBf1fF96Ac1a9

Curve math contract address: 0xF9A2a3d760291b59E3D358C7FfaCc62F724fA913

Ponzi.fan Registry: 0xc29258389D26C558dee2Fb78E80049b59d97B689